Keep on top of member updates and important issues, trends and

regulatory changes that impact your clients and your business.

Pre-budget consultations in advance of the 2022 federal budget (update)

CALU submission to the Department of Finance with recommendations to best support economic growth, make life more affordable and build an even stronger economy for the future. View the ...

CALU Special Report – Valuing corporate owned life insurance: A new twist

In this CALU Special Report, Valuing corporate owned life insurance – A new twist, Kevin Wark, LLB, CLU, TEP, Tax Advisor, CALU takes a look into the valuation of corporate-owned life insurance in determining Ontario estate administration taxes.

Economic and Fiscal Update 2021

MPs in the House of Commons are in a FES-tive mood today – and the cedar garlands adorning the walls of Parliament Hill aren’t the only reason. The federal government’s long-awaited Fall Economic Statement was delivered by Finance Minister and Deputy Prime Minister Chrystia Freeland today.

INFOexchange 2021 vol. 4 is now available

INFOexchange volume 4 is out as of today! Chair Barry Pascal reflects on the past year and looks forward to a bright year ahead.

2021 Fall Conference – recap

Our virtual 2021 Fall conference was a success! We had a great turnout of attendees who had the opportunity to listen to many insightful presentations by a handful of industry experts. Thank you to all of those who participated and made this possible.

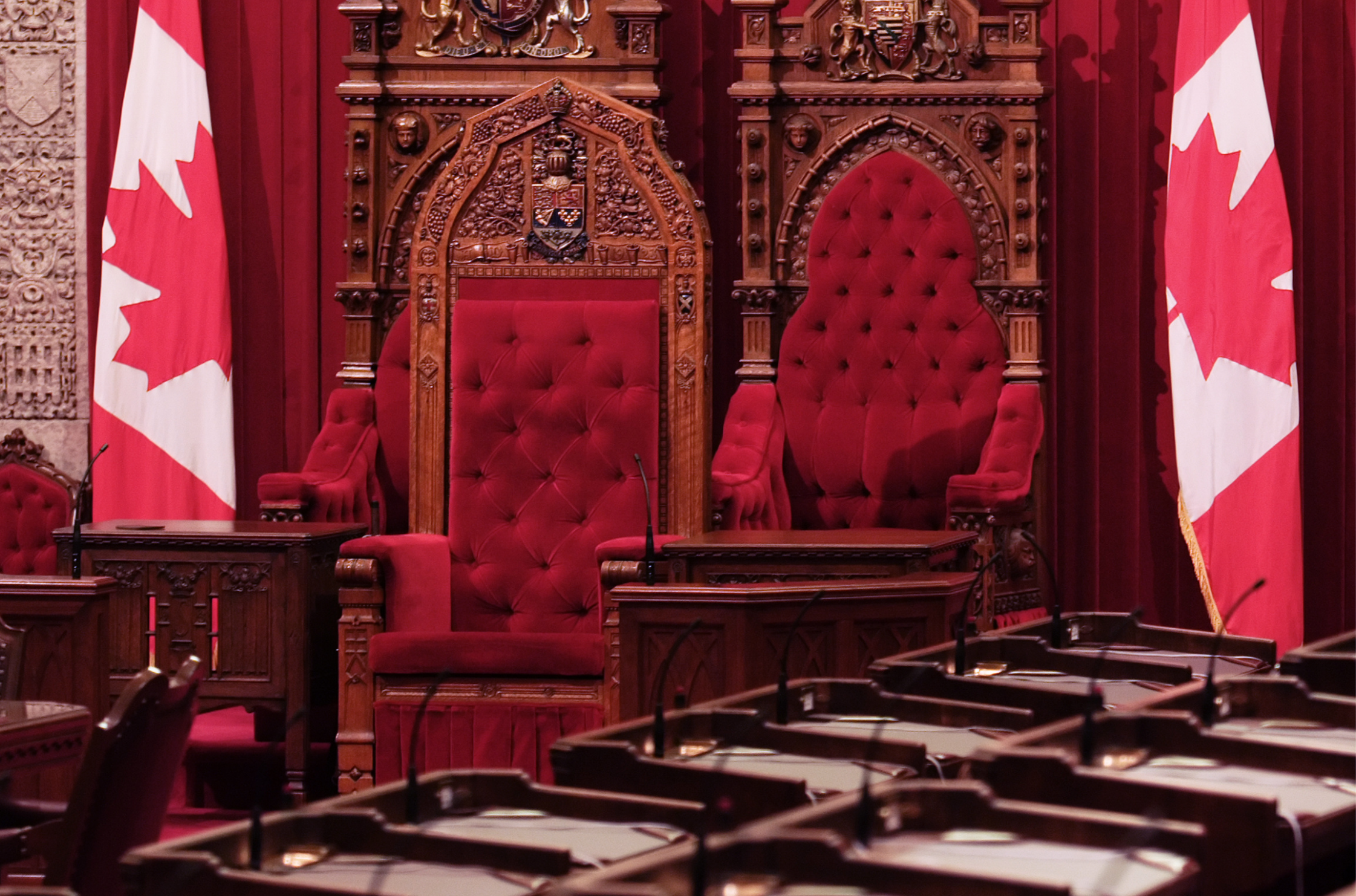

CALU advocacy update – 2021 Speech from the Throne

Last week, the Governor General delivered the throne speech to open the 44th parliament and outline the governments agenda. Although the speech was very high level, there were no surprises and it fell closely in line with previous policy statements by this government.

CALU Practice Note – Revisiting provincial rebating and inducement rules

This new Practice Note revisits one of the marketing practices discussed in the March 2019 Practice Note, and also reviews another marketing practice which may raise concerns with provincial regulators as being a form of policyholder rebate or inducement.

Elite Advisors Program – elevate your business

Transform your professional online presence with the Elite Advisors Program for CALU members.

Federal cabinet announced

CALU offers its congratulations to all 38 new and returning federal cabinet ministers. The cabinet was announced by the Prime Minister and sworn in by the Governor General this past ...

CALU Report – Private corporate tax accounts: Timing is everything

The Income Tax Act (ITA)1 establishes a number of different tax accounts for private corporations to ensure proper integration of taxes with shareholder distributions and to minimize tax avoidance transactions.

CALU submission to consultation on the Underused Housing Tax

CALU comments to the Department of Finance on its consultation relating to the underused housing tax announced in Budget 2021. View the submission

CALU Practice Note – Advisor/client consideration in purchasing foreign life insurance policies

Canadian individuals and private corporations often acquire life insurance policies to meet liquidity needs on death, as well as accumulate capital on a tax-advantaged basis during the lifetime of the insured